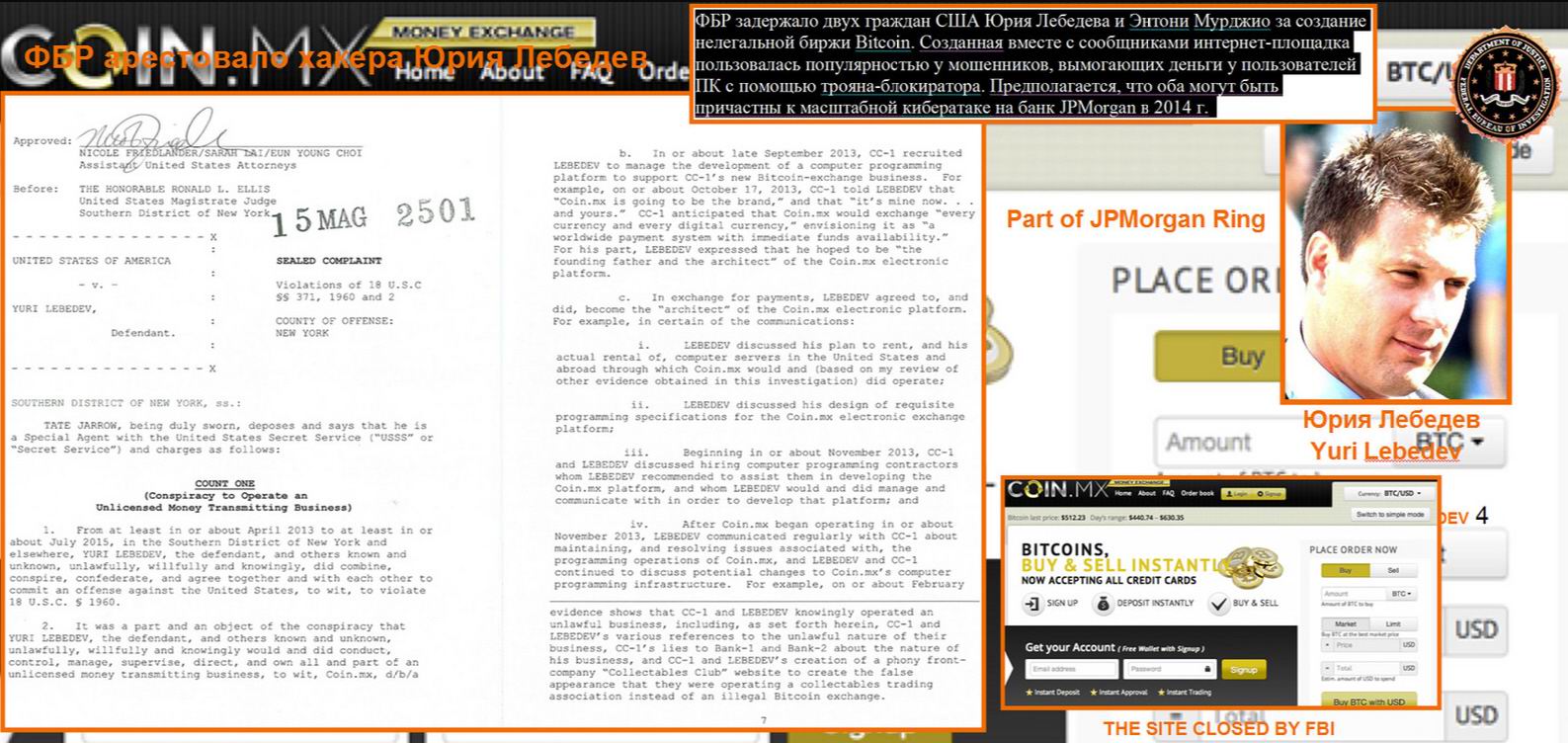

| Preet Bharara, the United States Attorney for

the Southern District of New York, and Diego Rodriguez, Assistant Director-in-Charge

of the New York Field Office of the Federal Bureau of Investigation (“FBI”),

and Robert J. Sica, Special Agent in Charge of the U.S. Secret Service

New York Field Office (“USSS”) announced today the unsealing of an indictment

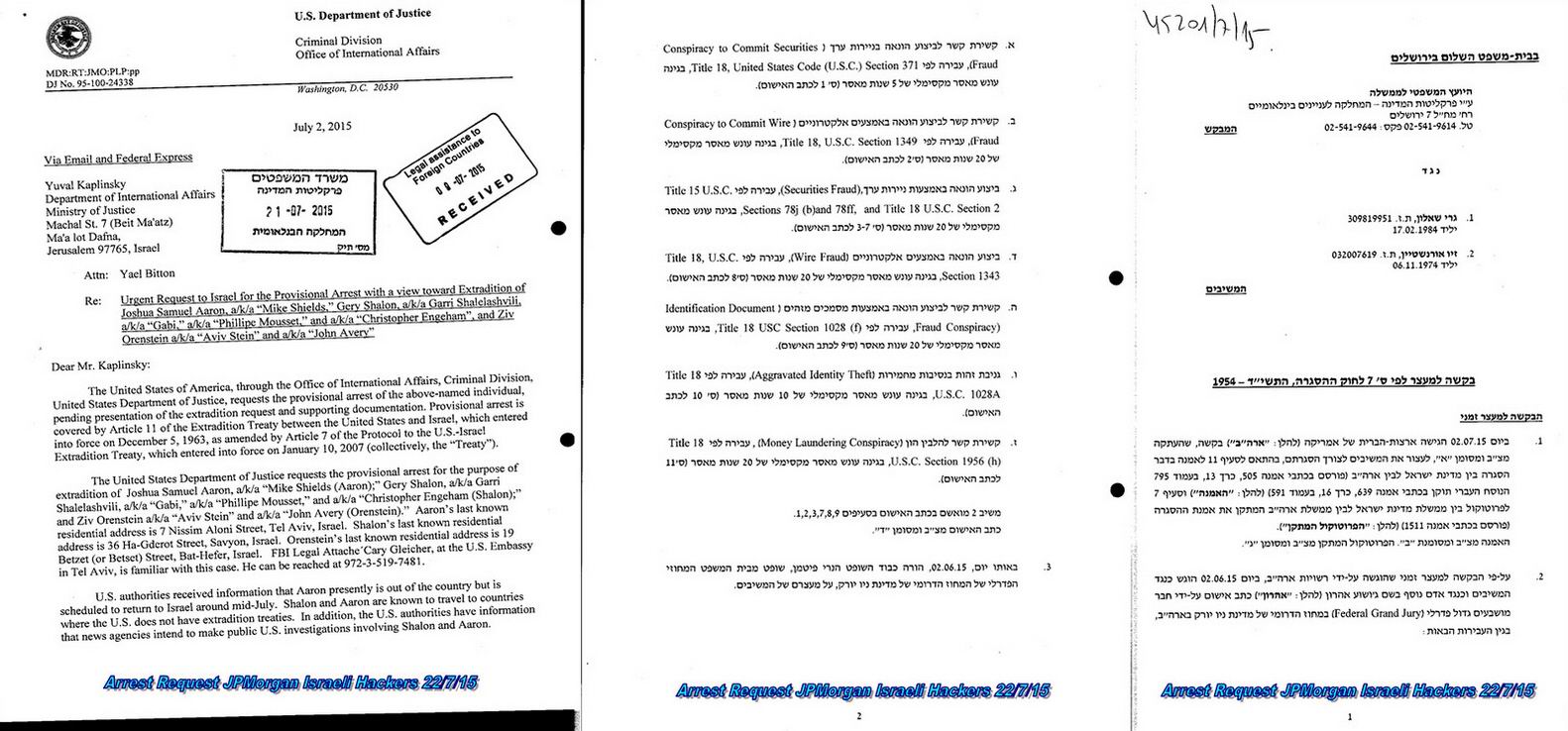

charging GERY SHALON, JOSHU.S.MUEL AARON, and ZIV ORENSTEIN with orchestrating

a scheme to manipulate the price and volume of traded shares in numerous

publicly traded stocks by means of deceptive and misleading e-mail campaigns,

and manipulative, prearranged stock trading. SHALON and ORENSTEIN were

arrested today in Israel by the Israel Police. The United States Attorney’s

Office will seek their extradition to stand trial in the United States.

AARON remains at large.

Manhattan U.S. Attorney Preet Bharara said: “As

alleged, the defendants manipulated trading in U.S. securities from overseas,

using fake identities to funnel millions of dollars in unlawful proceeds

through a web of international shell companies. Using false and misleading

spam e-mails sent to millions of people, these defendants allegedly directed

their pump-and-dump scheme from their computers halfway around the world.”

FBI Assistant Director-in-Charge Diego Rodriguez

said: “Crimes, such as the ones alleged herein, are multinational and complex

in nature. The defendants are alleged to have profited in the millions

of dollars and defrauded innocent investors for their own gain. The FBI

is committed to working with our partners, both foreign and domestic, to

ensure the integrity of our markets and protect our communities from fraud

and deception, regardless of the scheme, means, or medium.”

USSS Special Agent in Charge Robert J. Sica said:

“This case highlights the Secret Service’s investigative skills and our

commitment to collaborate with our partners in detecting and dismantling

highly sophisticated transnational criminal enterprises targeting the United

States. These crimes can have a detrimental impact to our nation’s critical

financial infrastructure. The Secret Service, in conjunction with its many

law enforcement partners across the United States and around the world,

is committed to deploying cutting edge investigative practices and technology

in order to bring these offenders to justice.”

In a separate action, the United States Securities

and Exchange Commission (“SEC”) announced civil charges against SHALON,

AARON and ORENSTEIN.

According to the allegations contained in the

indictment unsealed today in Manhattan federal court:1

Since 2011, SHALON, AARON, ORENSTEIN, and their

co-conspirators have orchestrated multi-million dollar stock manipulation—or

“pump and dump”—schemes to manipulate the price and trading volume of numerous

publicly traded microcap stocks (“penny stocks”) in order to enable members

of the conspiracy to sell their holdings in those stocks at artificially

inflated prices. In furtherance of the conspiracy, SHALON and AARON partnered

with “promoters” who identified the companies whose stock would be targeted

for manipulation. In doing so, AARON acted as the scheme’s “front-man,”

using the alias “Mike Shields” (including false identification and a Social

Security Number belonging to another person) to communicate with the promoters

and others at SHALON’s direction. In some instances, at the time SHALON

and AARON partnered with the promoters, the targeted companies were already

publicly traded, and in other instances, SHALON and AARON worked with the

promoters to cause the companies to become publicly traded in furtherance

of the scheme. In either case, upon partnering with the promoters, SHALON,

AARON and the promoters agreed upon the compensation SHALON and AARON would

receive for their role in the scheme, which typically amounted to either

hundreds of thousands of dollars, or to shares in the targeted stock that

SHALON and AARON typically sold for hundreds of thousands or millions of

dollars in profits in the course of the scheme.

Also in furtherance of the conspiracy, the promoters—along

with, at certain times, SHALON and AARON—acquired control over all or substantially

all of the free-trading shares of the targeted stock, that is, shares that

the owner could trade without restriction on a national stock exchange

or in the over-the-counter market. At certain times, in furtherance of

the scheme, when they acquired such free-trading shares, SHALON and AARON

held the shares in brokerage accounts in the United States, which were

opened in the names of shell companies (the “Brokerage Accounts”) and managed

in part at SHALON’s direction by ORENSTEIN under aliases that ORENSTEIN

supported with false and fraudulent passports and other false personal

identification information.

As a further part of the scheme to defraud, after

members of the conspiracy acquired control of a substantial portion of

the free-trading shares of the targeted stock, SHALON, AARON, and their

co-conspirators artificially inflated the stock’s price and trading volume

through two fraudulent and deceptive means. First, certain members of the

conspiracy typically executed pre-arranged manipulative trades to cause

the stock’s price to rise small amounts on successive days. Second, in

connection with that trading, SHALON and AARON began disseminating materially

misleading, unsolicited (“spam”) e-mails—e-mailing up to millions of recipients

per day—that falsely touted the stock in order to trick others into buying

it. As orchestrated by SHALON and AARON, these e-mails contained materially

false and fraudulent statements including, for example, (i) that the stock’s

recent trading activity reflected legitimate demand for the stock (when

in fact, and as AARON and SHALON well knew, the trading activity was caused

in whole or in part by the manipulative trading of their co-conspirators)

and (ii) that the e-mails were being distributed and financed by certain

third parties when, in fact, and as AARON and SHALON well knew, the e-mails

were being distributed and financed by SHALON, AARON, and their co-conspirators,

who controlled all or nearly all of the free-trading shares of the stock.

After causing the stock’s price and trading volume

to increase artificially during the days or weeks of the e-mail promotional

campaign, members of the conspiracy (including, when they owned shares,

SHALON and AARON) began dumping, or selling, their shares in a coordinated

fashion, often resulting in huge profits to members of the conspiracy.

SHALON and AARON alone earned millions of dollars in illicit profits this

way, selling shares of manipulated stocks from the Brokerage Accounts in

coordination with their e-mail promotional campaigns and co-conspirators.

The co-conspirators’ massive coordinated sales typically placed downward

pressure on the stock’s price and caused its trading volume to plummet,

exposing unsuspecting investors to significant losses. SHALON and AARON

then laundered their criminal proceeds overseas, directing millions of

dollars of their criminal profits to a shell company bank account in Cyprus

for further distribution in part to another Cyprus-based shell company

account owned and controlled by AARON, and to other overseas shell company

accounts beneficially owned and controlled by SHALON and other members

of the conspiracy.

***

The maximum potential sentences in this case

are prescribed by Congress and are provided here for informational purposes

only, as any sentencing of the defendants will be determined by the judge.

SHALON, 31, of Savyon, Israel, and ORENSTEIN,

40, of Bat Hefer, Israel, are Israeli nationals, and were arrested earlier

today at their residences. AARON, 31, a U.S. citizen who resides in Moscow,

Russia, and Tel Aviv, Israel, remains at large.

Mr. Bharara praised the investigative work of

the FBI, the USSS, and expressed his sincere gratitude to the Israel Police

and the Israel Ministry of Justice for their support and assistance with

the investigation. He also thanked the SEC.

The prosecution of this case is being overseen

by the Office’s Complex Frauds and Cybercrime Unit. Assistant U.S. Attorneys

Nicole Friedlander, Sarah Lai, and Eun Young Choi are in charge of the

prosecution. Assistant U.S. Attorney Alexander Wilson of the Office’s Money

Laundering and Asset Forfeiture Unit is in charge of the forfeiture aspects

of the case.

The charges contained in the indictment are merely

accusations, and the defendants are presumed innocent unless and until

proven guilty.

1As the introductory phrase signifies, the entirety

of the text of the indictment and the description of the indictment set

forth below constitute only allegations, and every fact described should

be treated as an allegation. |